Managed service providers are entering a more demanding phase of the market, and it’s not subtle.

Today’s MSP supports more endpoints, more vendors, more security requirements, and more compliance obligations than they did just a few years ago. At the same time, labor costs are rising, experienced talent is harder to retain, and clients expect faster resolution, clearer communication, and ongoing proof of value.

The problem? Visibility hasn’t kept up with complexity.

Most MSP owners know their top-line MRR. Far fewer can clearly see which clients are profitable, which services are eroding margin, or where labor is being misallocated week after week. Lagging reports, or worse, gut instinct still drive pricing decisions, staffing changes, and renewal strategies.

That gap is where profit leaks form.

A “good” client quietly turns unprofitable. A fully booked team still misses margin targets. QBRs become defensive instead of strategic. Leadership spends more time reacting than steering.

This is why more mature MSPs are starting to adopt a new approach: Profit Intelligence Platforms. Not as another dashboard, but as a way to connect financial performance, service delivery, and operational decisions in real time.

Which raises the question:

Why are these platforms quickly becoming a requirement for MSPs who want to stay profitable in 2026 and beyond?

The Growing Profitability Challenge Facing MSPs

Before answering why MSPs need a Profit Intelligence Platform, it’s worth understanding how we got here.

Most MSPs don’t struggle to generate revenue. In fact, many are growing. They’re adding clients, expanding service offerings, and stacking MRR year over year. On paper, the business looks healthy.

But revenue growth alone doesn’t guarantee profitability—or sustainability.

What’s increasingly difficult is understanding how that revenue turns into profit… and where it quietly disappears along the way. Rising labor costs, more complex service stacks, security demands, compliance work, and client expectations have fundamentally changed the economics of managed services. Every client, ticket, and agreement now carries more variability than it did even a few years ago.

The challenge isn’t effort. It’s clarity.

Most margin pressure inside MSPs comes from a small set of familiar issues:

- Client demand outpacing contract value

- Labor being “busy” but inefficiently deployed

- Services expanding without clear margin ownership

- Problems surfacing long after they could’ve been corrected

MSPs aren’t short on tools. PSAs, RMMs, and accounting systems all do their jobs well. Platforms like ConnectWise Manage excel at capturing operational activity—tickets, time, agreements, and resources.

What they don’t do is explain why profitability shifts or where operational decisions are working against the business.

As a result, leadership teams review margins after the fact, make decisions based on averages, and uncover issues weeks or months too late. That’s how even well-run MSPs end up operating reactively: busy, growing, and still frustrated by inconsistent profitability.

Why Traditional MSP Reporting Falls Short

When profitability doesn’t line up with expectations, most MSPs respond in a predictable way: they turn to reporting. Leaders dig deeper into PSA reports, export data into spreadsheets, layer on BI tools, and build dashboards in an effort to explain where margins went off track. Given the tools MSPs already use, this feels like the most reasonable next step.

But even with modern platforms, this approach often introduces different problems.

Instead of improving clarity, reporting efforts become increasingly manual and backward-looking. Teams spend more time assembling data, validating numbers, and reconciling inconsistencies than acting on what they’re seeing. While the tools themselves are digital, the decision-making process becomes slow, fragmented, and highly dependent on interpretation.

The issue isn’t the volume of data available. It’s the assumption behind how that data is used.

Traditional MSP reports depend on conditions that rarely exist in day-to-day operations: timely and accurate time entry, consistent process adherence across teams, and uniform service delivery. Real MSP environments are far more variable. Time is logged late or in batches, tickets are miscategorized, and work frequently happens outside ideal workflows.

When those realities aren’t accounted for, reporting breaks down in a few predictable ways:

- Reports require explanation before they can be trusted

- Numbers spark debate instead of alignment

- Decisions are slow as teams reconcile data rather than act on it

As confidence in the data erodes, leadership still reviews reports, but the focus shifts away from decision-making. Meetings become about validating numbers instead of addressing root causes, and by the time an issue is clearly understood, the opportunity to correct it has often passed. At that point, reporting can describe what already happened, but it can’t reliably guide what should happen next. That limitation is where traditional MSP reporting reaches its ceiling and where a different approach to profitability becomes necessary.

What a Profit Intelligence Platform Actually Is

A Profit Intelligence Platform is designed to bridge the gap between operational data and executive decision-making.

It doesn’t replace your PSA, RMM, or financial systems, and it doesn’t ask your team to work differently just to feed it data. Instead, it sits above those systems, pulling information together and interpreting it through the lens that matters most to MSP leadership: profitability, efficiency, and operational maturity.

Where traditional tools tell you what happened, Profit Intelligence focuses on why it happened and what to do next. That means moving beyond surface-level metrics and answering more meaningful questions, such as:

- Why did profitability change even though revenue stayed flat or increased?

- Which day-to-day behaviors are helping, or quietly hurting the margin?

- Where is operational drag forming inside service delivery or account management?

- What issues require leadership attention now, not at month-end or quarter-end?

This is the fundamental shift. Profit Intelligence doesn’t just summarize activity; it contextualizes it. It connects financial outcomes back to the operational decisions and behaviors that created them.

In doing so, it turns operational noise into signal, giving leadership a clear, prioritized view of what’s actually influencing profit inside the business.

How does this platform work inside an MSP

Inside an MSP, profitability is rarely driven by a single metric. It’s the result of how people, processes, and systems interact over time.

A Profit Intelligence Platform looks for patterns across those interactions, not just isolated numbers. It evaluates how work actually flows through the organization, how consistently processes are followed, and how closely service delivery aligns with financial expectations.

For example, consider a mid-sized MSP whose revenue has grown steadily, but margins have started to slip. Traditional reports show nothing obviously wrong: Utilization looks acceptable, and no single client appears dramatically unprofitable. On paper, the business seems stable, but profit intelligence tells a different story.

By connecting operational and financial data, the platform surfaces a pattern: a subset of “good” clients is generating higher-than-average ticket volume after hours, handled by senior technicians. Time entry for that work is often delayed or inconsistently categorized, which masks the true labor cost.

Individually, none of these behaviors raises alarms. But together, they quietly erode margin every month. Without Profit Intelligence, this issue might only become visible during a quarterly review; long after the impact is felt. With it, leadership sees the trend forming in near real time and can act early by adjusting coverage models, realigning technician assignments, or revisiting contract terms.

This is where the platform earns its name.

It doesn’t just report outcomes; it connects behavior to impact. It highlights how late time entry, utilization imbalances, delivery inefficiencies, or misaligned incentives influence profitability before those issues become structural problems. The result is earlier visibility, clearer priorities, and the ability to course-correct while there’s still room to protect margin.

How FITware Delivers Profit Intelligence for MSPs

FITware was built to solve a problem we repeatedly saw inside growing MSPs: revenue increasing while profitability became harder to explain, harder to protect, and harder to manage with confidence.

In conversations with MSP owners and leadership teams, the same patterns came up again and again. Reports didn’t align. Client profitability raised questions without clear answers. Staffing decisions felt reactive. Everyone had data, but no one had a complete, reliable view of how day-to-day operations were shaping financial outcomes.

The platform was designed with those realities in mind. Rather than adding another reporting layer, it uses existing operational and financial data to surface insight that leadership can trust and act on. The features below reflect that focus.

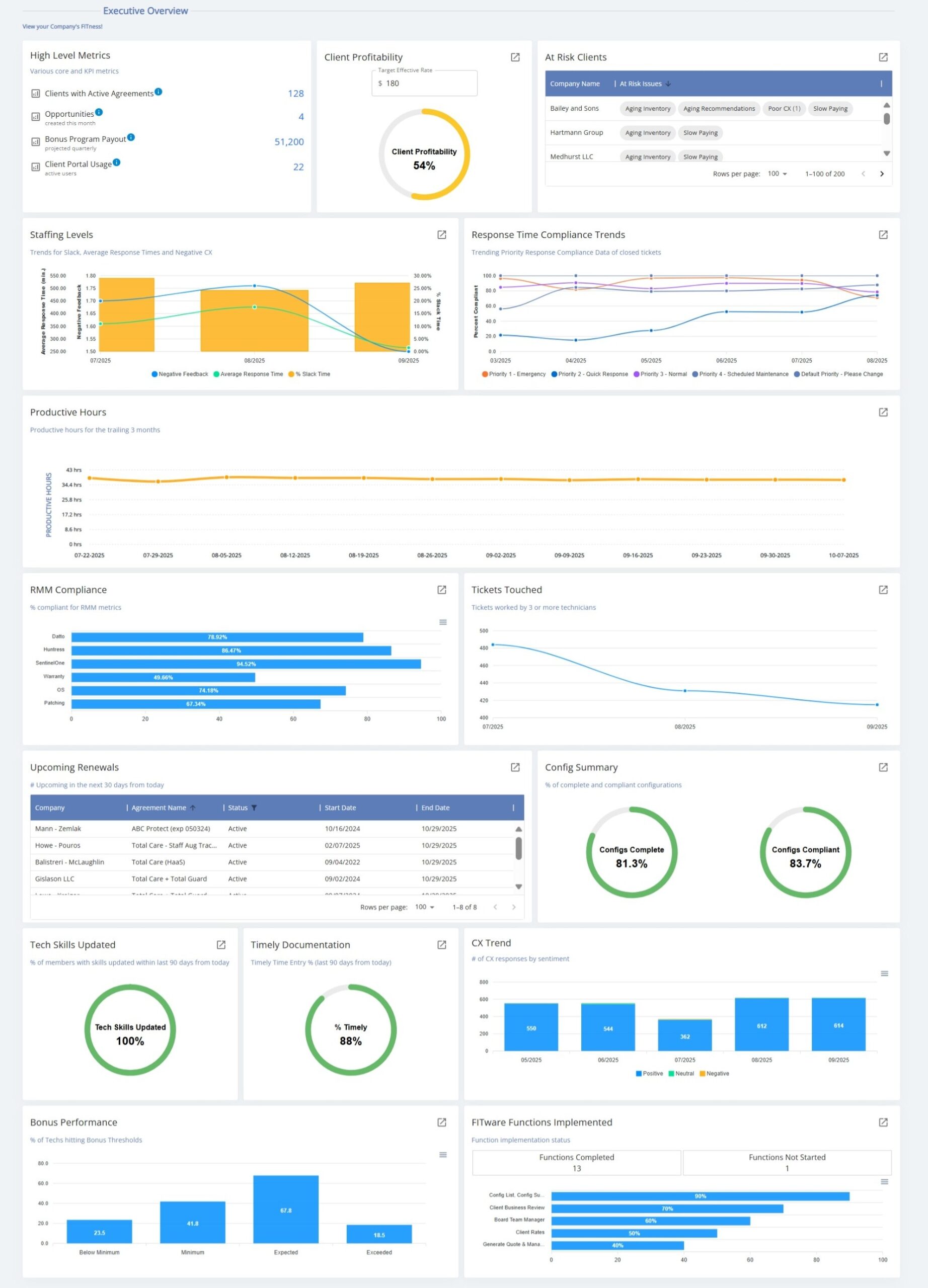

Executive-Level Visibility Without Guesswork

Most executive dashboards overwhelm more than they inform. They surface dozens of KPIs, leaving leadership to decide which ones matter and how they relate.

The FITware Executive Overview is intentionally different. It consolidates operational and financial signals into a single, trusted view that highlights trends tied directly to profit, such as efficiency drift, margin risk, and early signs of operational strain.

Instead of asking, “What should I be looking at?”, MSP owners can quickly answer higher-impact questions: Is the business operating within healthy ranges? Where is performance starting to deviate? Which areas require intervention before margins are affected?

This allows leadership to stay ahead of issues without living inside reports.

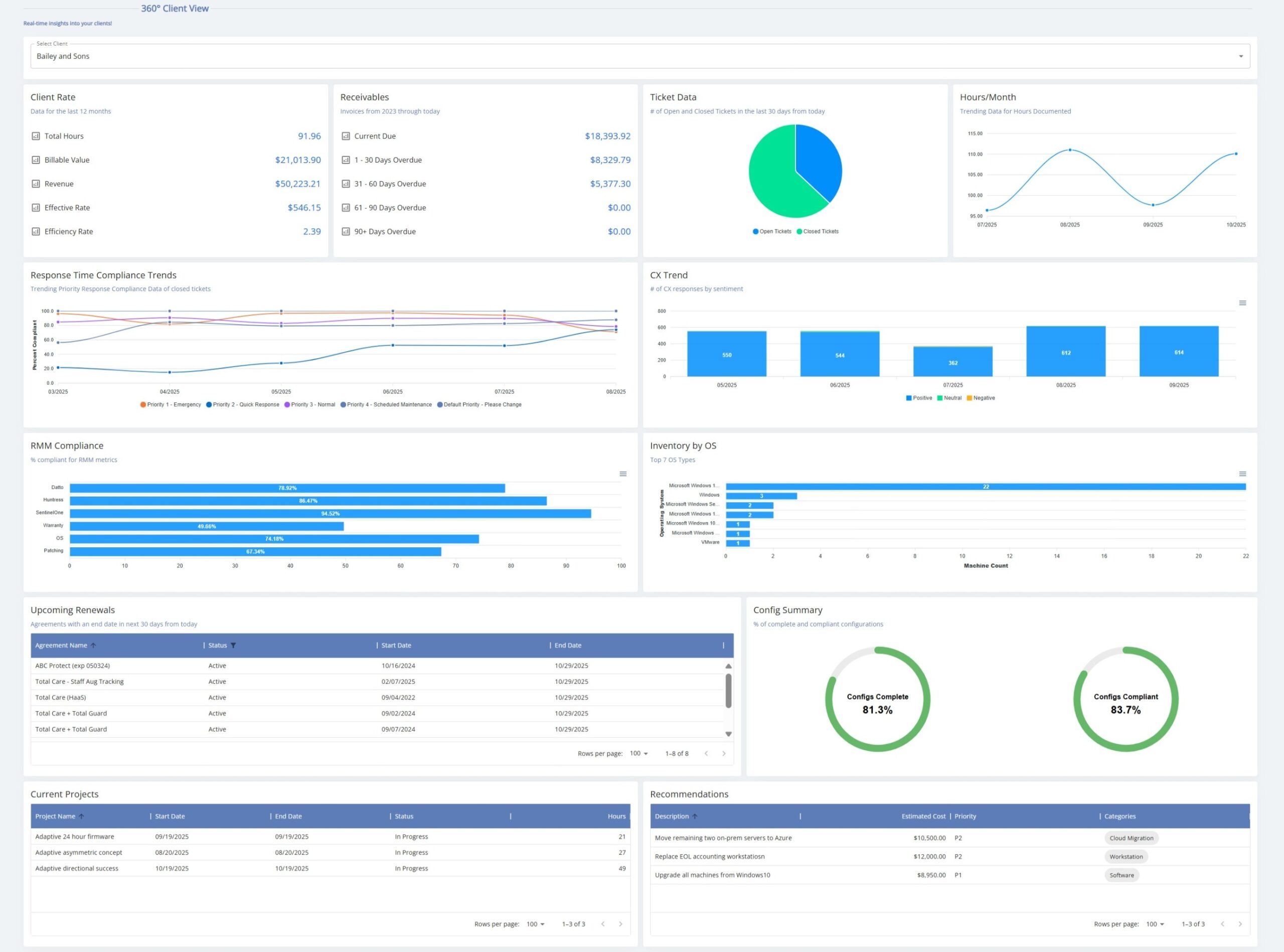

Accurate Client Profitability—With Context

Client profitability is one of the most requested—and least trusted—views inside MSPs. The data exists, but it’s often fragmented and difficult to interpret with confidence.

FITware’s 360 Client View brings together time accuracy, ticket activity, agreement alignment, and utilization context to tell a complete story. Instead of simply flagging a client as unprofitable, it shows why: whether the issue stems from excess support demand, misaligned scope, delivery inefficiencies, or data quality gaps.

This context matters. It allows MSPs to have informed conversations about pricing, scope, and service adjustments based on facts, not assumptions. And it helps leadership distinguish between clients that need intervention and those that simply need better alignment.

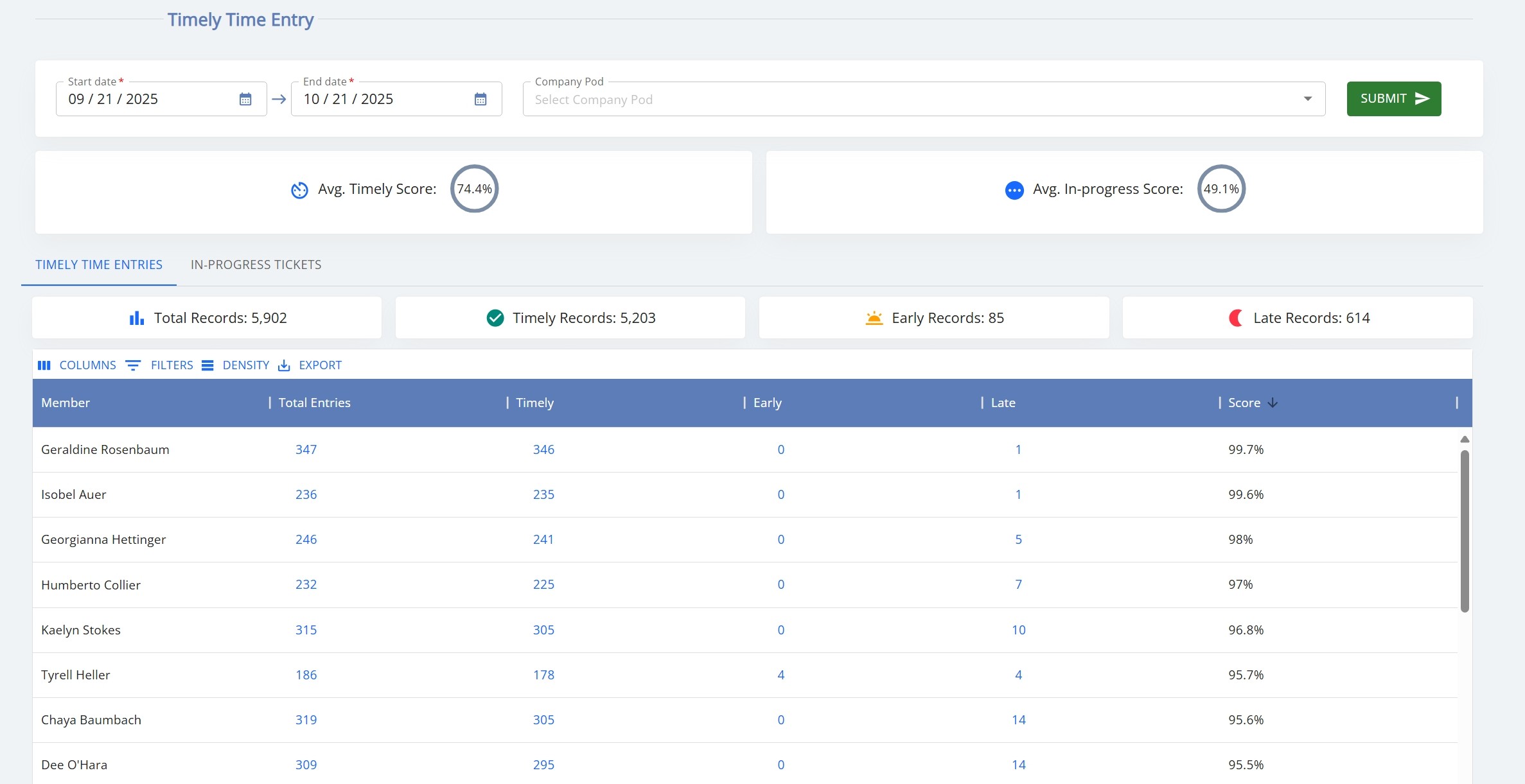

Timely Time Entry as a Profit Signal

Late or inconsistent time entry distorts nearly every metric an MSP relies on. Yet it’s often treated as an administrative annoyance rather than a financial issue.

FITware treats timely time entry as what it really is: a foundational profit signal. By tracking compliance trends and quantifying the financial impact of delays, the platform makes data quality visible and actionable. Leadership can see where time accuracy is breaking down, how it affects reporting confidence, and which teams or workflows need adjustment, without relying on constant reminders or manual enforcement.

Over time, this creates more reliable data and more trustworthy insight across the organization.

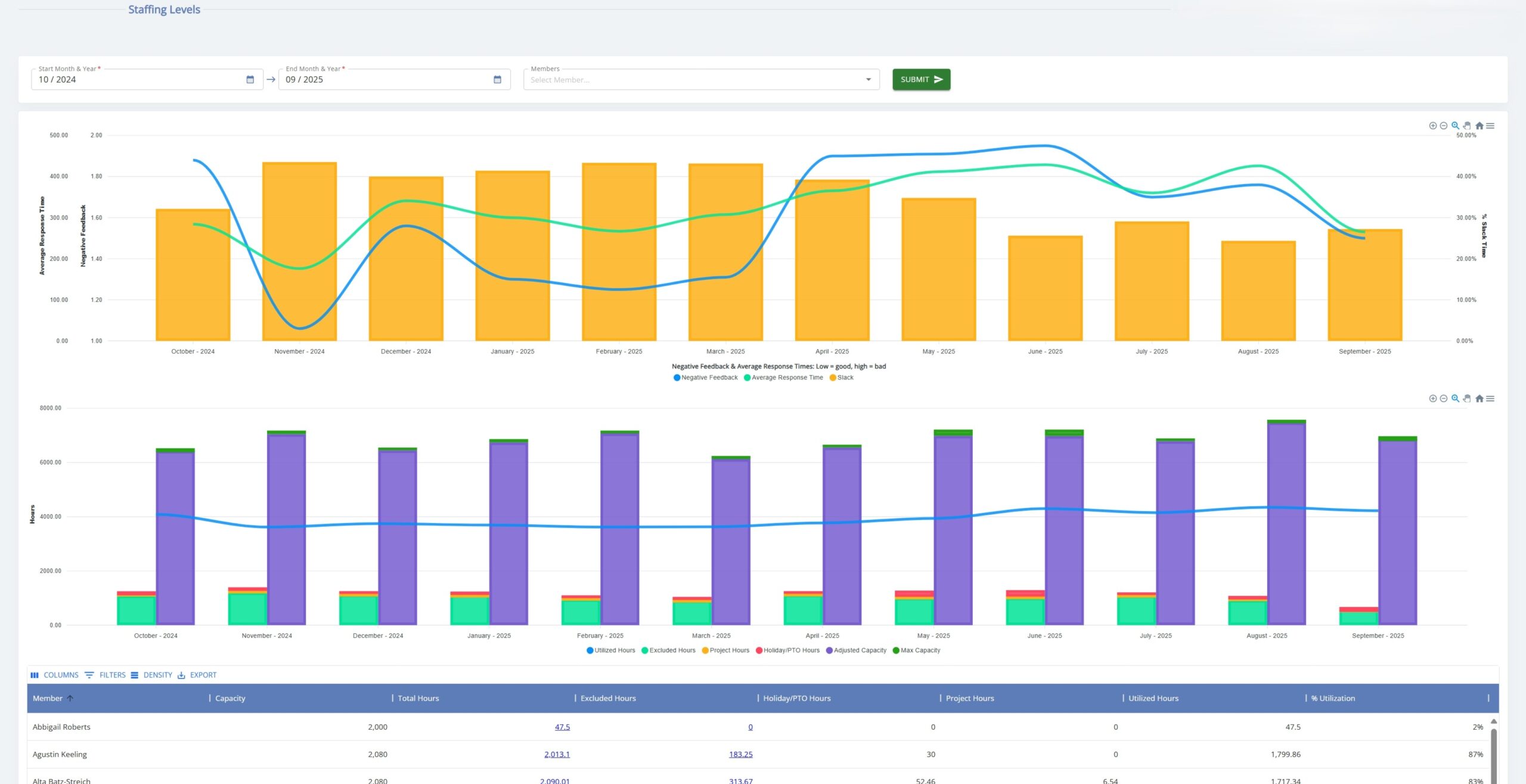

Staffing and Utilization in Context

Utilization metrics are frequently misunderstood when viewed in isolation. A team can appear fully utilized and still be misaligned with demand, skill requirements, or profitability goals.

The platform’s staffing and utilization views provide the missing context. They show how workload is distributed, where capacity constraints are forming, and whether the right work is being handled by the right people at the right cost.

This enables MSP leaders to make more informed decisions about hiring, restructuring, and role alignment, based not just on activity levels, but on actual business impact.

Turning Insight Into

Behavior Change

Visibility alone doesn’t change outcomes.

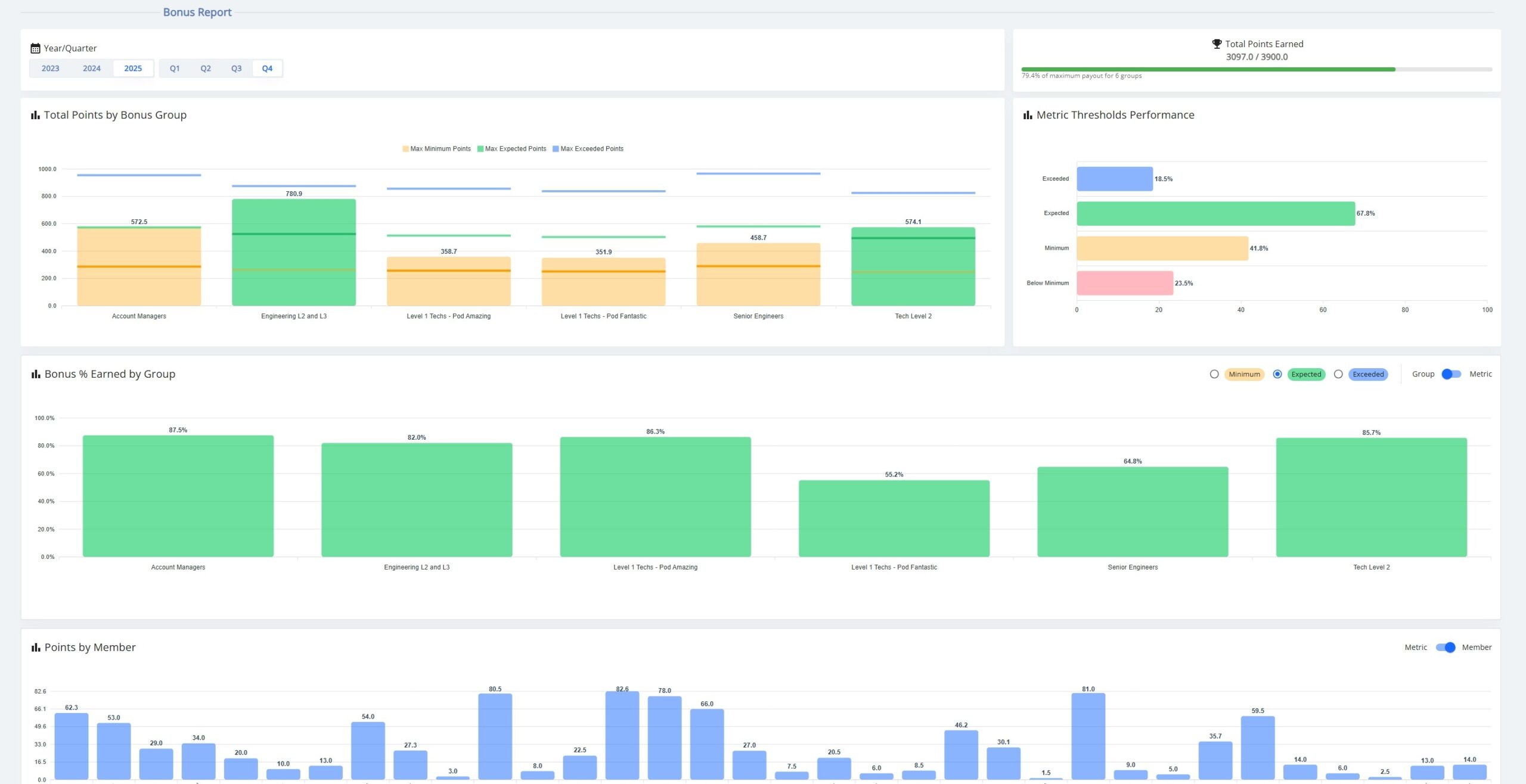

FITware closes the loop by connecting operational insight to incentive and accountability structures. By aligning measurable performance metrics with bonus programs and team goals, MSPs can reinforce behaviors that protect margin and improve efficiency.

Instead of policing activity, leadership creates clarity around what success looks like and rewards it consistently. The result is sustainable improvement that supports both profitability and culture.

Why MSPs Will Need Profit Intelligence in 2026

The MSP market is heading into a year where traditional visibility and intuition won’t be enough to maintain healthy margins or make confident decisions.

Industry forecasts show that AI and analytics will move from “nice to have” to core business strategy in 2026. Nearly nine out of ten organizations are expected to increase AI spending next year, and many are embedding AI into active production environments to drive cost savings and revenue growth. At the same time, business leaders increasingly expect measurable outcomes from their technology investments, not just experimental pilots.

For MSPs, this shift matters on several fronts:

Margin and cost pressure won’t relax.

Revenue growth alone won’t shield MSPs from the realities of rising labor costs, heightened competition, and client demand for predictable outcomes. As services become more complex (spanning cybersecurity, cloud orchestration, automation, and AI-enabled offerings), the cost of delivery and staffing risk silently erodes profitability faster than revenue grows. Traditional reporting can’t surface these dynamics in real time.

AI adoption will reshape operational expectations.

AI-driven automation and analytics are rapidly becoming essential in MSP operations. Forward-looking providers are already using AI to automate routine work, triage tickets more intelligently, and uncover patterns in operational data that humans alone can’t see reliably. That means competitors who adopt deeper, real-time insight tools will have faster, more accurate decision cycles, and MSPs without that insight will struggle to keep pace.

Clients will demand clarity on business impact.

Across industries, organizations aren’t just buying managed services; they’re buying business outcomes. They want transparency into cost drivers, return on IT spend, and how technology partners support efficiency and growth. Surface-level reporting that stops at “what happened last month” won’t satisfy that expectation.

Data volume and complexity will outgrow legacy reporting.

Analytics trends for 2026 point toward real-time insight, explainable AI, and decision-ready data becoming standard expectations, not premium features. MSPs face exponentially more data from RMM, PSA, endpoints, security tools, and client systems. Piecing that together into a reliable picture of profitability and operational health without intelligent interpretation won’t scale.

In this context, Profit Intelligence isn’t just a differentiator; it’s becoming a survival tool. It gives MSP leaders clarity on where costs are growing, why margins shift, and which operational patterns meaningfully affect outcomes. That clarity becomes the foundation for deliberate pricing, staffing, service design, and growth strategy in 2026.

Clarity Is the Competitive Advantage

The challenges MSPs face today aren’t driven by a lack of growth or demand. They’re driven by increasing complexity and the difficulty of understanding how daily operational decisions affect financial performance.

As margins tighten, services expand, and client expectations rise, relying on hindsight or disconnected reporting introduces unnecessary risk. MSPs that perform well in 2026 will be the ones that have a clear, timely understanding of how profit is being generated and where it is being put at risk, with enough visibility to make informed adjustments before issues become costly.

Profit Intelligence supports that shift by connecting operational activity to financial outcomes in a way leadership can trust and act on. Rather than adding more tools or more reports, it provides a clearer foundation for pricing, staffing, service design, and growth decisions.

For MSPs planning ahead, the question is no longer whether profitability deserves attention. It’s whether the business has the visibility required to manage it deliberately as it scales.

If that clarity is missing today, we’re happy to help.

Connect with us to see how FITware can fit into your MSP.